By John Bozzella

The Treasury Department is out with its long-awaited and (almost) final set of proposed rules for the EV tax credit in last year’s Inflation Reduction Act (IRA).

This is the biggest piece of outstanding guidance for the $7,500 customer incentive (aka 30D) and outlines how automakers will account for the value and origin of the critical minerals and components in EV batteries.

Before I dig into all that… first, some good news: EV sales had a record run in 2022.

Market share continues to rise: 8.5 percent in Q4 and 10 percent in December. There is momentum and product excitement. Automakers are introducing more EVs every month – across all segments and price points. Consumers will be able to choose from 150 EV models by 2026.

EV and battery manufacturing is also ramping up in the U.S. Supply chains are localizing and allies are talking about specialized mineral trade agreements (more on that below). That’s going to have an impact over the long term and help achieve our shared goal: domestic EV supply chains that can support this 100-year change in the industrial base and reduce U.S. reliance on foreign countries.

Questions I’m asked each time Treasury issues new rules: Which EVs – make and model – now qualify for the tax credit… and which don’t? What’s in or out? Where is the website with the list?

Short answer: I don’t know. It’s not a question that can be answered today. Automakers will report directly to the IRS which EV models (effective April 18) meet the critical mineral and/or battery component requirements.

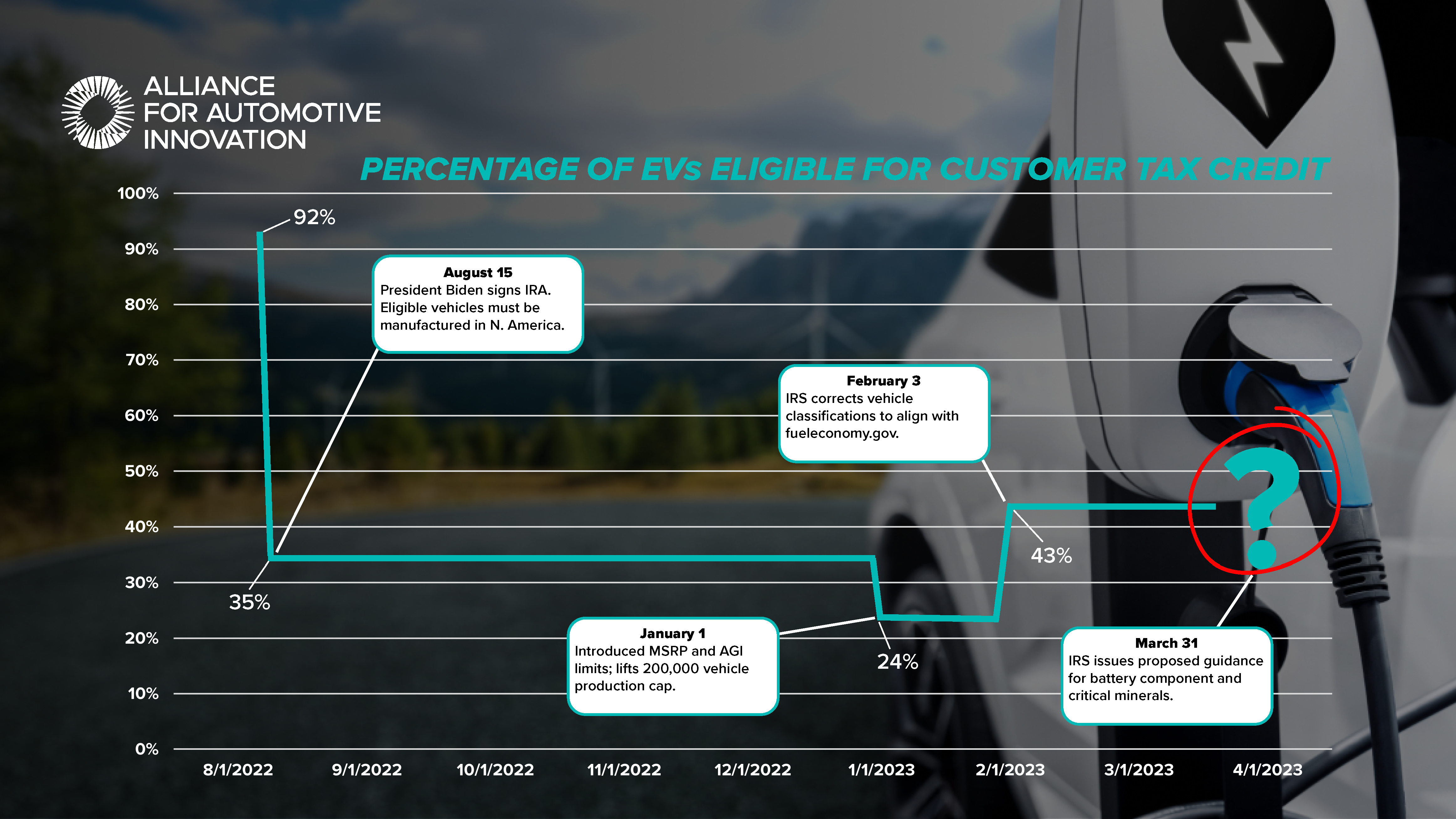

Here’s what I can say: this latest turn will further reduce the number of eligible EVs. Fewer vehicles (and fewer customers) will qualify for the full $7,500 credit in the near term.

In fact, this period may go down as the highwater mark for EV tax credit eligibility since the IRA passed last year.

First the EV had to be assembled in North America – taking 70 percent of EVs off the field. Additional owner income and MSRP caps were added in January. When Treasury released the last set of rules back in January, just 37 EV models qualified for the credit (about 40 percent of the 91 EV models for sale today).

Now come the strictest and most convoluted rules yet – the mineral and battery sourcing requirements.

Quick refresher: Congress split the revised $7,500 EV tax credit in two and based eligibility on a battery electric, plug-in electric or fuel cell vehicle meeting certain requirements related to the origin of the battery’s critical minerals and components.

Forty percent of the critical minerals in the EV battery must be extracted or processed in the U.S. – or in a country with a U.S. free trade agreement. Pass this test, the credit is worth $3,750.

Sidebar: we urged the department to consider free trade agreements that could include mineral agreements with the European Union and Japan. Those discussions between the U.S. and our allies are ongoing, which is positive and will help more quickly reduce reliance on China.

Fifty percent of the battery components must be manufactured in North America. That’s the other $3,750. Both thresholds ramp up significantly in the next few years (topping out at 80 percent for minerals and 100 percent for components).

How many EVs meet all those requirements and qualify for the full $7,500 credit now?

My best guess: few of the 91 models currently for sale. Some EVs will certainly qualify for a partial credit. Given the constraints of the legislation, Treasury’s done as well as it could to produce rules that meet the statute and reflect the current market.

Lots of questions about anodes and cathodes too. The guidance says: anode and cathode manufacturing must occur in North America. That’s consistent with the IRA statute. And critical mineral processing can occur in countries where the U.S. has free trade agreements.

What’s left? A ‘foreign entity of concern’ provision kicks in over the next two years. It says if any material amount of components or minerals sourced from a problematic country (read: China) are used in an EV battery… that vehicle won’t qualify for a tax credit. Even if the battery meets the thresholds I outlined above – any component (starting in 2024) and any critical mineral (starting in 2025) from China automatically disqualifies the vehicle from the credit.

We now know the EV tax credit playing field for the next year or so. March 2023 was as good as it gets.

Automakers have been working to help customers and dealers understand the ins and outs of this very complex credit. We’re introducing websites and other tools to help decipher these rules so drivers in the market for an EV (and do yourself a favor and give one a test drive) can easily determine which EVs qualify and, most importantly, how they can receive the credit.

John Bozzella is president and CEO of Alliance for Automotive Innovation.